income tax rates 2022 australia

6 rows Tax Rates 2021-2022 Year Residents Tax Scale For Year Ended 30 June 2022 Taxable IncomeTax. The 420 LMITO boost means a worker earning the median income will receive a 07 tax cut this year but if the offset is not extended beyond 2021-22 will receive a 25 tax increase next year.

Excel Formula Income Tax Bracket Calculation Exceljet

The new cost of living offset together with the low and middle income tax offset LMITO for 202122 will provide around 12 billion in support when taxpayers lodge their tax returns from 1 July 2022.

. At A Glance Treasury Gov Au. Make sure you click the apply filter or search button after entering your refinement options to find the specific tax rate and code you need. 37c for every dollar between - 180000.

Tax Rates 2021-2022 Year Residents Tax Scale For Year Ended 30 June 2022 Taxable IncomeTax On This Income 0 to 18200 Nil 18201 to 45000 19c for each 1 over 18200 45001 to 120000 5092 plus 325c for each 1 over 45000 120001 to 180000 29467 plus 37c for each 1 over 120000. This is on top of around 16 billion in permanent tax relief that will flow to households in. No tax on income between 1 - 18200.

The following tables sets out the PIT rates that currently apply to resident and non-resident individuals for the. Taxable Income Tax Rate. Individual income tax rates.

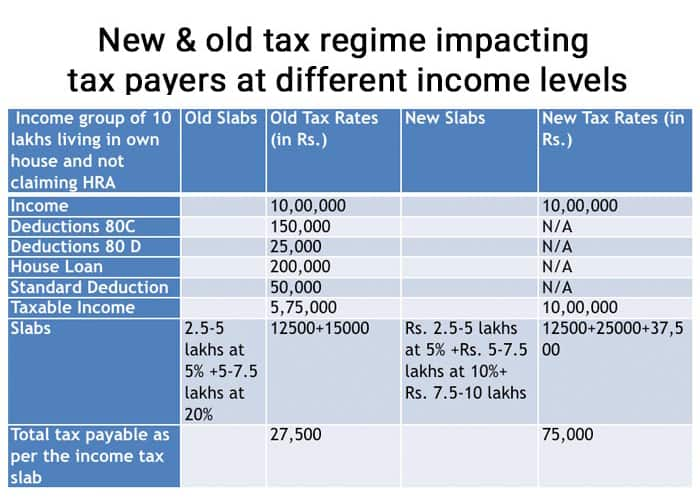

Personal Income Tax Rate in Australia is expected to reach 4500 percent by the end of 2021 according to Trading Economics global macro models and analysts expectations. Australia Personal Income Tax Tables for 2022. The next phase of the tax cuts will eventually remove the 325 and 37 marginal tax rates which will result in around 94 of Australian taxpayers facing a marginal tax rate of 30 or less in the 202425 and later income years.

Wednesday March 16 2022. Tax on this income. C for every dollar over 180000.

325c for every dollar between - 0. 6 rows Taxable income Tax rate Taxable income Tax rate. Provision For Income Tax Definition Formula Calculation Examples.

This was originally intended to be recovered at. Base rate entity company tax rates The company tax rate for base rate entities has fallen from 275 to 26 in 20202021 financial year and is now down to 25 for 20212022 and later income years. See also Pittsburgh Steelers 2022 Mock Draft Individuals On Incomes Below 18200 Are Also Entitled To The Low And Middle Income Tax Offset Lmito.

This is expected to take effect from 1 July 2022. Further under the Governments initiative the LITO will be recovered at a lower rate of 5 cents per dollar for taxable incomes between 37500 and 45000 and an additional 15 cents per dollar from taxable incomes between 45001 and 66667. Tax Rates 2022-2023.

Mon 28 Mar 2022 1106 EDT Last modified on Mon 28 Mar 2022 1133 EDT Joe Biden will propose a new tax on Americas richest households when. What Tax Do I Pay In Australia 24000 Australia. Income tax rates 2022 australia.

5 rows Low and Middle Income Tax Offset LMITO income tax rates and thresholds for 2022. In the australia tax calculator superannuation is simply applied at 105 for all earnings above 540000 in 2022. On Dec 7 Minnesota Management And Budget Mmb Released Its Budget Forecast For Fiscal Year 2022 23 Which Foresaw A 7 746 In 2022 Tax Services Tax Season Income Tax.

Even if you earn no Australian income if youre. You can find our most popular tax rates and codes listed here or refine your search options below. Reflected in the above table are tax rate changes from the 2018 Budget for the 2 years from 1 July 2022 to 30 June 2024 which include an expansion of the 19 rate initially to 41000 and lifting the 325 band ceiling to 120000.

Despite moving away from Australia expats still need to consider Australian tax rules. Australia Personal Income Tax Rate was 45 in 2022. A subsequent Budget 2019 measure further expanded the 19 income ceiling to 45000 from 1 July 2022.

Individual income tax rates. Australia has a bracketed income tax system with five income tax brackets ranging from a low of 000 for those earning under 6000 to a high of 4500. In the long-term the Australia Personal Income Tax Rate is projected to trend around 4500 percent in 2022 according to our econometric models.

325c for each. A base rate entity for an income year is. 19c for every dollar between 18201 - 0.

How To Calculate Foreigner S Income Tax In China China Admissions

Online Tax Return Australia Lodge Tax Return Tax Refund Irs Taxes Tax Season

Australian Income Tax Brackets And Rates For 2021 And 2022

Singapore Tax Rate Personal Individual Income Tax Rates In Singapore Updated

Income Tax Rates Slab For Fy 2021 22 Or Ay 2022 23 Ebizfiling

Old Vs New Income Tax Slab Policybazaar

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Poland Personal Income Tax Rate 2021 Data 2022 Forecast 1995 2020 Historical

Personal Income Tax Cuts 2018 2025 What It Means For You

Income Tax Deductions Tax2win Newupdates Wintaxes Taxsaving Efiling Itr Tax Deductions Income Tax Income Tax Return

Australian Companies Are Willing To Accept Cryptocurrencies If Regulated In 2022

Average Corporate Income Tax Rates In Europe Surrounding Countries Vivid Maps Europe Map Map Europe

Personal Income Tax An Overview Sciencedirect Topics